From Then to Now

Over the past 2 decades, you’ve seen Headline invest in hundreds of companies, but what you might not have seen, is the technology and team we've been investing in behind the scenes to power these deals. As a venture capital firm, some might say that our own firm is starting to resemble the software startups we invest in. That’s because we’ve shaped Headline around a global team of 17 industry-leading engineers, data scientists, and technologists tasked with building proprietary data-driven ML platforms to give our investors and founders a competitive advantage. This technology has been key to the success of scaling our global investment strategy.

We want to give you a look behind the curtain to better understand how Headline uses technology to both source and vet investments and help founders better understand their businesses.

Searchlight: Data-driven sourcing

As a global firm, we have always prioritized looking outside of the main tech hubs to find the most interesting, fastest-growing companies. This also means looking outside of our networks to expand our scope of view. This also helps us make it easier for founders from non-traditional backgrounds to raise capital. To help us scale this approach and identify the real hidden gems of the startup world, we built our own data-driven sourcing platform called Searchlight.

Searchlight is a platform accessible by Headline’s global investment team. It continuously scans millions of websites from around the world to identify the most interesting, fast-growing companies our investors should be looking into. Over the past 12 years, we’ve built Searchlight to analyze dozens of data sources from across the web, making it the largest repository of startup data in the ecosystem. Using machine learning, Searchlight is able to cross-reference, rank and filter companies based on a set of proprietary algorithms that our engineering team have honed over years of research. Our data engines are not only critical in identifying companies early in their development, but also in providing peer-to-peer benchmarks for analyzing growth and performance of early stage companies across multiple sectors.

We started building Searchlight over 12 years ago as a way to help us see the unseen. Today, Searchlight scans the web to find breakout stars across the 4 sectors we invest in: consumer tech, fintech, vertical SaaS and infrastructure SaaS. Some of the most recent improvements include the application of proprietary algorithms which allow Searchlight to rank companies based on overall performance and potential for growth within their given sector.

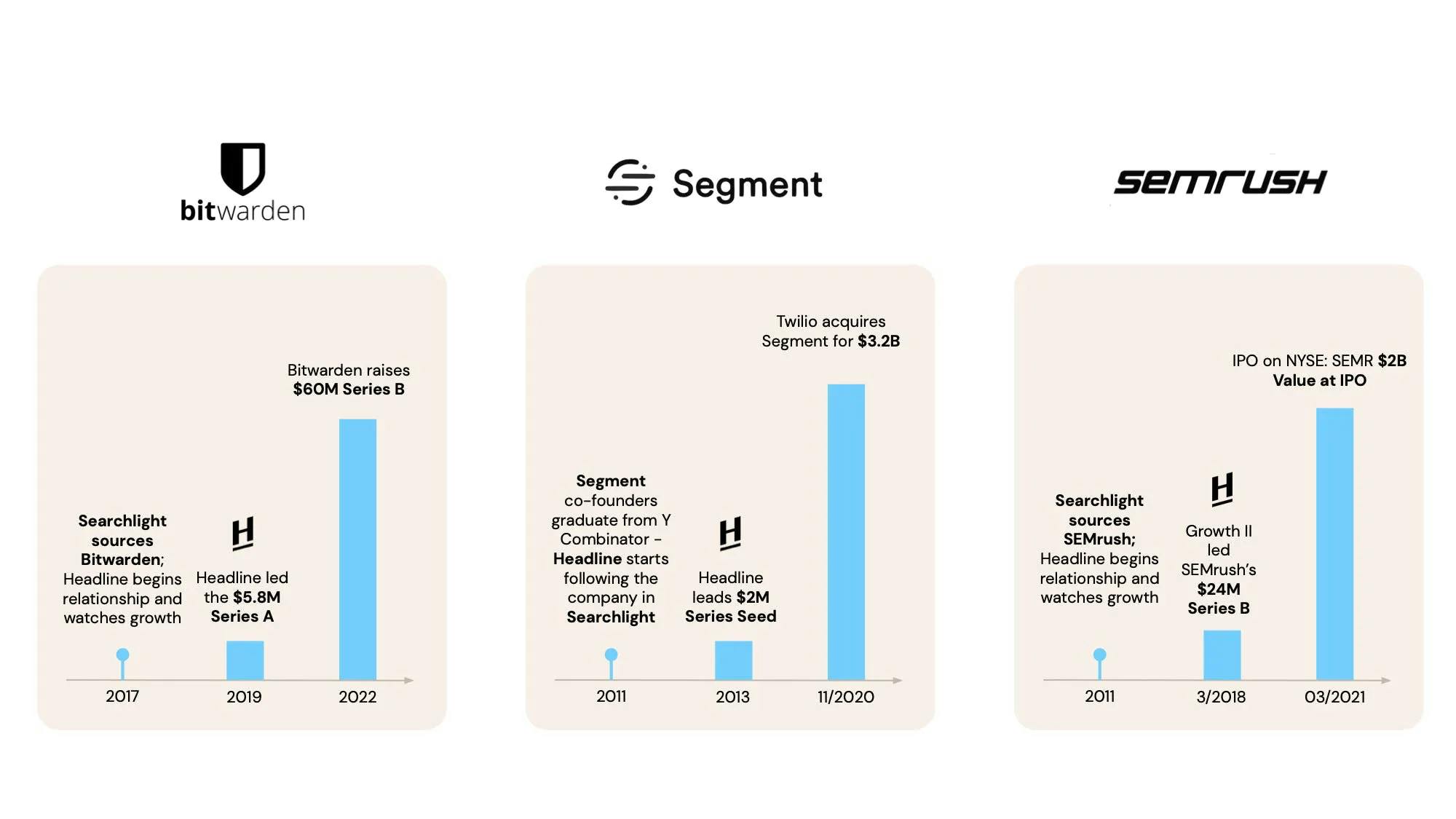

With over 7 million companies tracked and billions of data points collected over a decade, our teams are able to quickly prioritize which companies to talk to in a scalable, repeatable manner. Searchlight gives Headline’s investors a powerful edge in sourcing leads from all over the world, and has led to our discovery of companies like Segment (acquired by Twilio), SEMRush (NASDAQ: SEMR), Bitwarden, and many others.

Deepdive: Technology-driven diligence

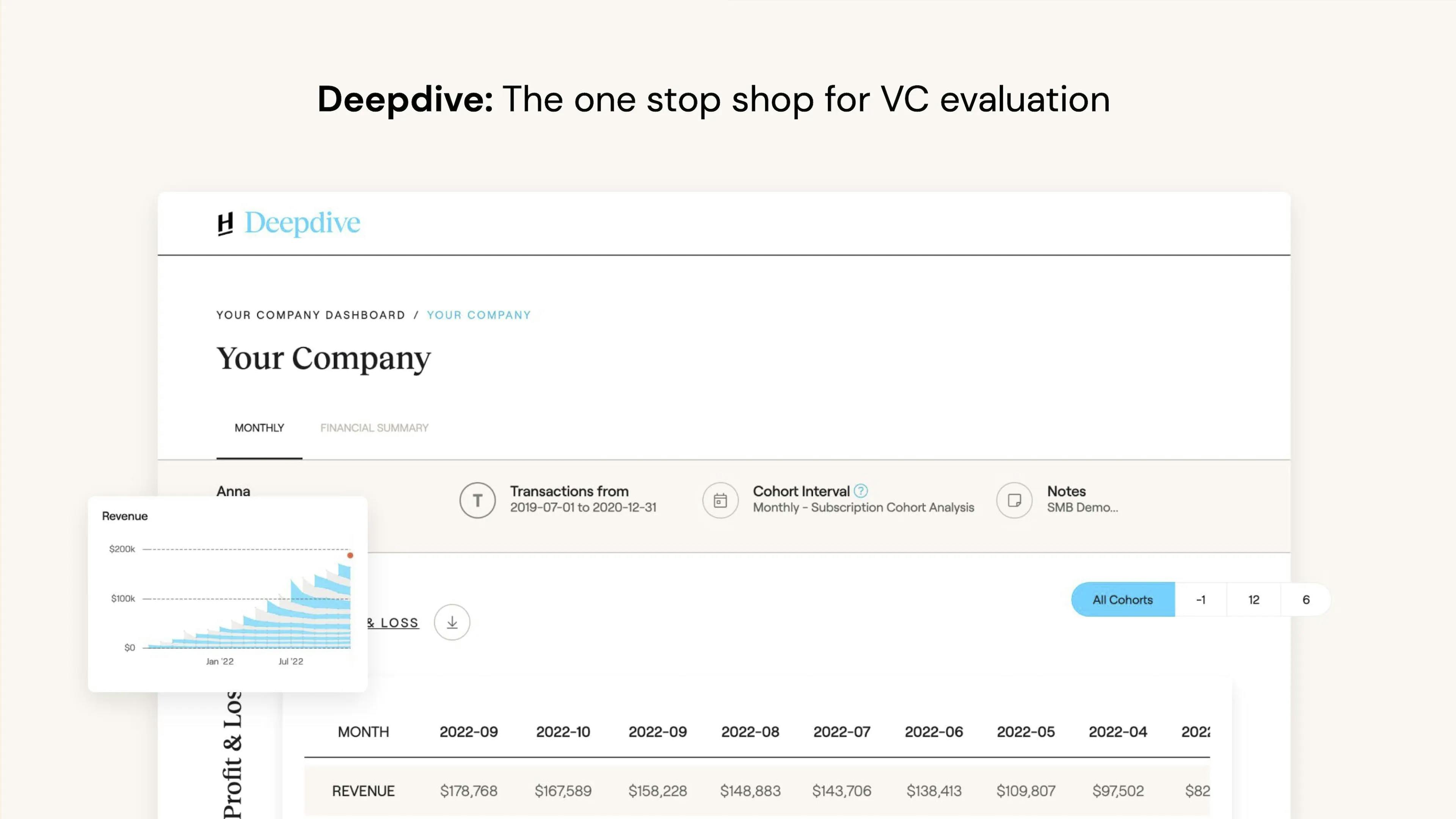

Another way we use technology to streamline our investment process at Headline is during diligence - as a way to save both our team and founders’ time. We first built Deepdive as a tool for our investors to quickly analyze financial and activity data early on in the investment process so they could see whether or not a company fits our thesis of strong unit economics, product-market fit and customer retention.

By combining financial and activity data in Deepdive, we’re able to see whether or not a company has found product market fit, alongside strong unit economics at the earliest stages. Our teams slice through metrics like user and revenue retention, CAC, and segmentation to help identify a company that fits our investment profile. At the Early Stage, we’re looking for companies with clear signs of product market fit. We define this as asymptotic customer retention and increased usage by retained customers over time. Looking at these metrics on a cohort by cohort basis enables us to identify for founders what is working and where additional attention might be needed.With a simple connection to a startup’s payment processing platform like Stripe or Chargebee, Deepdive is able to compute tens of charts and graphs in a matter of seconds, as compared to the hours it would take to compute manually in excel or SQL.

Today, Deepdive allows a founder to see their company the way a VC does. For every company we analyze, we share both the dashboard and our analysis of the company directly with the founder, whether we choose to invest or not. We believe this level of transparency is important in helping build trust and transparency in the venture investment process.

That’s why we decided to take this a step further and make Deepdive publicly available to all founders, for free. We know many founders don’t have operating or financial experience, so at a certain stage of the fundraising process, there can be a disconnect between the numbers founders present and what VCs are seeing. Deepdive makes it easy for anyone to analyze their company’s financial and activity data in just a few steps, create and share access to their Deepdive dashboard during the fundraising process and beyond.

Moving Forward

The flexibility of the technology we’ve built allows us to harness the power of data processing and machine learning while keeping the entire system adaptable to singular events as they arise. Combining advanced analytics with business acumen is at the core of our organization. From the advanced deal-finding capabilities of Searchlight to the powerful diligence analysis made simple in Deepdive, our platforms give Headline’s global investors a competitive edge. We’re proud to have built a global culture that believes in the power of data combined with the importance of collaborating together to employ the value of the human mind in all investment decisions. As a result, both our systems and team get better over time as we continue to make iterative improvements to capitalize on our successes while helping founders win bigger.