Before you raise, see how your business runs

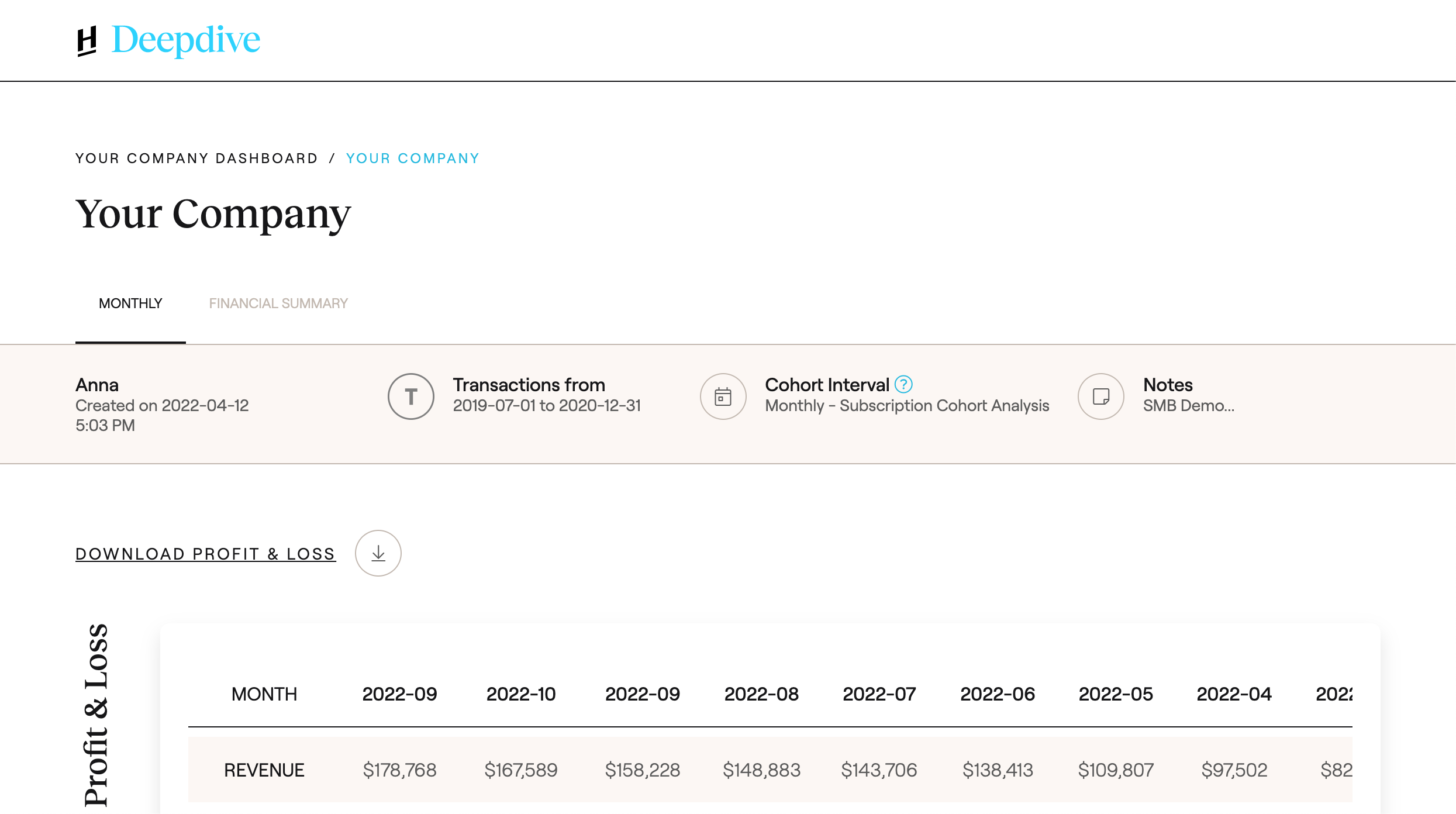

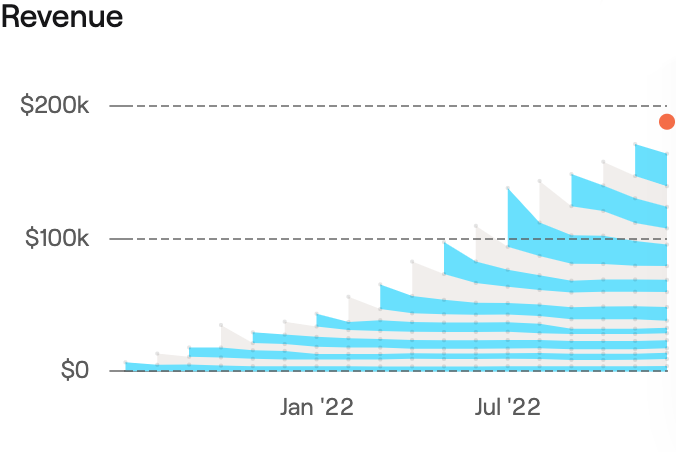

Deepdive equips founders with an inside look at the financial metrics VCs use to evaluate their business.

Get Started for Free Get Started

How it Works

How it Works

Prepare for the most rigorous

diligence questions

Prepare for the most rigorous diligence questions

Deepdive helps founders handle questions that are typical during a fundraise.

- How does your retention compare between new customers, and older ones?

- How have your customer payback dynamics changed as you scaled?

- What is the average revenue from your high-value vs low-value customers?

- How capital efficient is your business?

1-click effortless data ingestion

Features

Features

Discover what drives

your business

Features

Features

Benchmark Your Startup

With over 20-years of investing, Headline has built the tools to discern both signals of success and potential warning signs. We are opening up our formulas — because we believe founders deserve the first look inside their businesses.

About Us

About Us

A free and private

tool, by Headline

Over the course of two decades, we've developed our own technology to help our investing team detect success signals and warning signs. We’re opening our formulas and processes — because we believe founders deserve the first look inside their businesses.

MORE ABOUT HEADLINEGet access to an investment professional for feedback

Follow Deepdive Guides to help simplify complex concepts

Keep your data completely private, unless you choose to share it

Nicole Clark

/CEO, Trellis Law

"Utilizing Deepdive's segmentation analysis, we were able to obtain a granular insight into the distinct retention patterns of our enterprise versus non-enterprise customers. We could break up our overall retention into unique segments to provide context on what is truly driving the topline numbers. Deepdive made what was once a complex task into a simple and actionable UI."

Bianca Padilla

/CEO, CareWell

"Deepdive's segmentation analysis transformed the way we look at our customer base. By offering granular insights into the various retention patterns of our customer types, it unlocked a precise understanding of customer lifetime value across different segments. This insight allowed us to allocate our customer acquisition budget more strategically and efficiently. What was once a complex task has been made simple and actionable through Deepdive's user-friendly interface."

Brandon Brown

/CEO, GRIN

"Deepdive's 'Cumulative CAC Over S&M Spent' payback metric has become a critical KPI we use to monitor the efficiency of ramping up our customer acquisition efforts. We now use it in all our funding and board decks to properly visualize the return we get from investing in customer acquisition."

Harshit Dwivedi

/CEO, Aftershoot

"As a fast growing startup (without a proper data team), having access to Deepdive has been extremely helpful in keeping an eye on the key business metrics! I really love the extensive dashboards and drilldowns that it offers which let you go as broad or as deep as you want. I also love the "Benchmark" feature which compares you to other cos at the same scale and serves as a real-time reality check!"

Peter Stacho

/COO, Polygon.io

"At Polygon we're using Deepdive for accurate insights into our true customer LTV and how this is evolving over time, which is well beyond what Stripe reports could ever tell us. Simply dividing one with our annual churn rate and multiplying that with our average contract value is just a fictitious estimate."

Oz Uzuner

/VP of Product & Growth, Poplin

"As a data driven organization, we are getting tremendous value from Deepdive, and it complements our internal BI perfectly. And being able to share, analyze, and review our data with Headline only makes the process and relationship better and bigger for us. This level of support is hard to come by from investors, it's a really refreshing approach and a value add provided by Headline!"

Get in touch

- PRESS

- press@headline.com

- GENERAL

- hello@headline.com

- FOLLOW US