Article at a glance

- Burn Productivity assesses a company’s Return on Investment (ROI). This evaluation directly compares Gross Profit of the current period with the monies spent during the previous period to generate that profit. High Burn Productivity shows a correlation between investments made to attract and retain customers with profits that are generated as a result.

- Although traditional Valuation Methods are still widely used, we at Headline use Burn Productivity instead. Because it takes into account factors that drive Gross Profit, Burn Productivity has proven to be a more effective Valuation Method overtime as companies scale.

- At Headline, we use benchmarks to evaluate Burn Productivity to find companies with strong correlations between investments in Operations Expenses and resulting profits. These companies tend to have more experience, better understand customer behavior, and sell hot products or services that generate higher Gross Profits.

- Business leaders can increase Gross Profits by improving their company’s Burn Productivity and support them in becoming Best In Class.

What is Burn Productivity?

In a nutshell, Burn Productivity assesses Return on Investment (ROI) by looking at the profit of the current year that was generated as a result of the money spent on Operating Expenses (OPEX) during the previous year.

Burn Productivity More Effective than Traditional Valuation Methods

Traditionally, valuation was evaluated using two metrics called "Magic Number" and "Rule of 40." However, neither of these traditional metrics provide a correlation to value over time as companies scale that’s as accurate as Burn Productivity.

Burn Productivity outperforms traditional metrics because it factors in activities that feed Gross Profit and improve the value of a company over time. For example, R&D (Research and Development) should drive Product Development.

What is OPEX?

Operating Expenses (OPEX) is a critical component of Burn Productivity so we’ll begin by defining it. Then, we’ll get into the reason it’s so critical.

OPEX* is the sum of:

Sales and Marketing Expenses (S & M) +

Research and Development Expenses (R & D) +

General and Administrative Expenses (G & A) +

= Operating Expenses (OPEX)*

*Note: Cost of Goods Sold (COGS) is not included.

Comparison Provides Insight

When we compare these Operating Expenses (OPEX) from the previous period with the Gross Profits of the current period, we’re evaluating the Return on Investment (ROI). We use Burn Productivity to assess this ROI. To do this, we use the benchmarks outlined below but first let’s step through how we calculate Burn Productivity.

Calculation of Burn Productivity

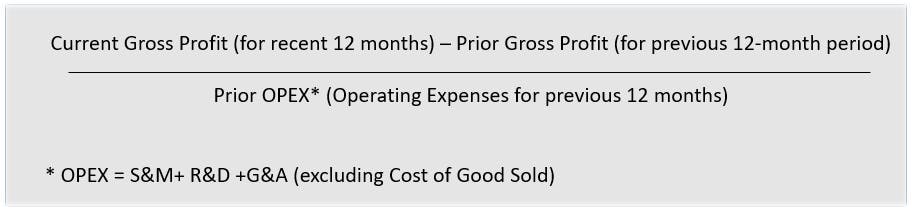

To calculate Burn Productivity, we divide the Gross Profit that’s added during the current period (e.g. current calendar year) by the Operating Expenses of the previous period (e.g. previous calendar year):

We use this metric to identify whether the money spent on Operating Expenses (OPEX) drove up a sufficient increase in Gross Profit. It does this by evaluating the effectiveness of Research and Development (R & D).

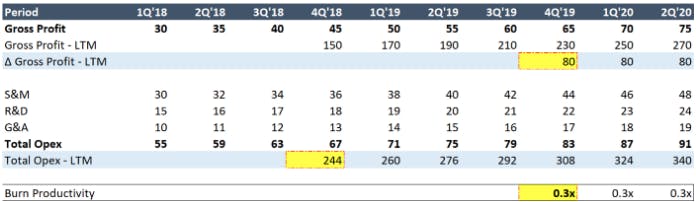

Below is an example:

Evaluating effectiveness of Product Development

Operating Expenses (OPEX) of the previous period in this calculation factors in Research and Development (R&D) to determine the extent to which the investment in Product Development caused an increase in customers’ adoption of the product.

By highlighting this correlation, we understand customer behavior and can also evaluate the company’s Go-to Market Strategy and identify R&D that reduces the cost of acquiring new customers.

Burn Productivity Benchmarks

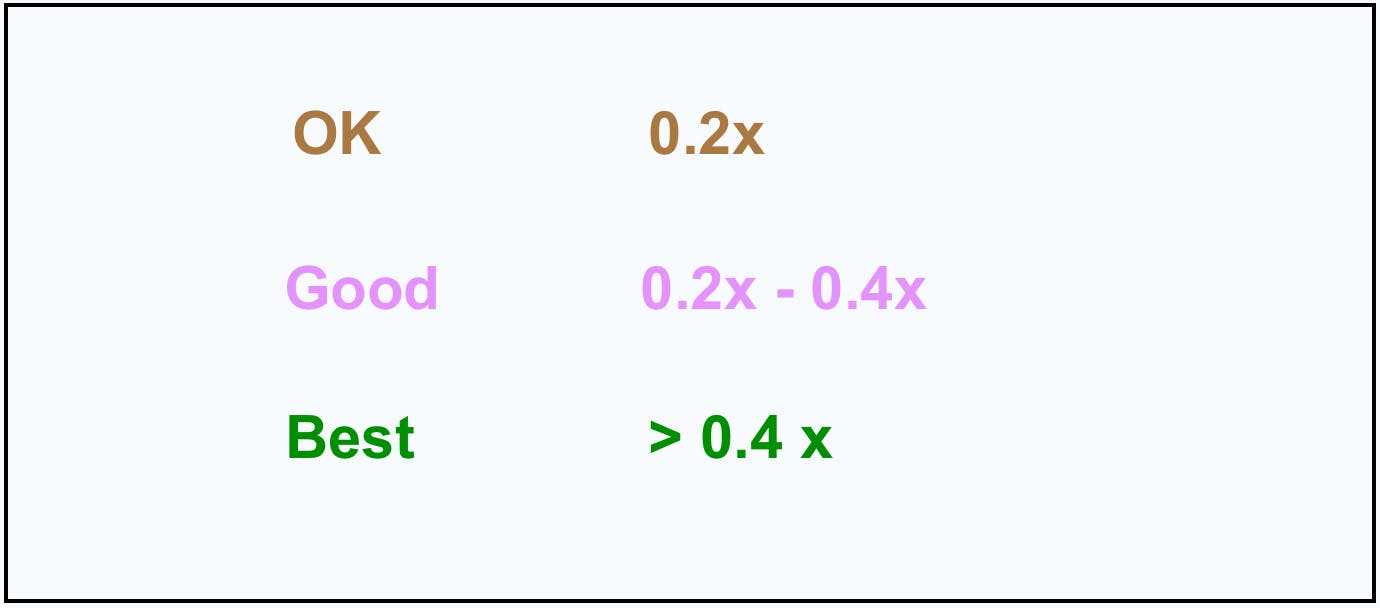

Below are general benchmarks for evaluating Burn Productivity:

The example above shows a Burn Productivity of 0.3x which is in the middle of the ‘Good’ range.

Looking for Best in Class

As a Venture Capitalist, Headline uses Burn Productivity when evaluating companies for potential investments.

Below is a more detailed outline of the benchmarks and how we use them to evaluate the impact that Operating Expenses (OPEX) has on customer behavior. We look not only at new customer acquisition, but also customer retention.

< 0.2x Below OK

We would not be interested in this company because there isn’t a strong enough correlation between the monies spent to attract and retain customers and the resulting profits.

0.2x OK

We would not dismiss this company and would look at other factors.

0.2x - 0.4x Good Range

This company is one that we’d look at more closely in hopes that better targeting Operating Expenses could improve Gross Profits and positively impact Customer Behavior.

> 0.4x Best In Class

This is a company that would get our attention because the focus of its Operating Expenses is generating sufficient Gross Profits. The company may be further along on its learning curve, better understand customers, or sell a hot product that generates higher Gross Profits.

Below are some characteristics of companies with the highest Burn Productivity:

- Freemium with Immediate Time to Value

- Low-cost Research and Development (R&D) Headquarters

- Vertical-specific

When we look back historically at successful businesses, there’s a correlation between a high Burn Productivity and long-term success. We also find that Burn Productivity more accurately forecasts success than traditional valuation methods.

As a result, we prefer using this metric when evaluating businesses. We share this information because Burn Productivity can provide rich insights to owners to support them in improving their businesses and becoming industry leaders.